Jewelry insurance information

Get tips for all things jewelry insurance with these articles. Learn when to get a policy, which coverage is right for you, how to make a claim, and more.

Explore Progressive's editorial standards for Answers articles to find out why you can trust the insurance information you find here.

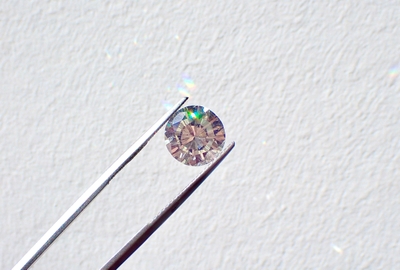

Protect your valuable jewelry today

Learn more about jewelry insurance policies.